All Categories

Featured

Table of Contents

No-load Multi-Year Guaranteed Annuities (MYGAs) on the RetireOne platform offer RIAs and their customers protection against losses with an ensured, dealt with rate of return. These solutions are interest-rate delicate, however might use insurance policy functions, and tax-deferred growth. They are favored by conventional capitalists looking for fairly foreseeable results.

3 The Squander Alternative is an optional feature that needs to be elected at agreement issue and topic to Internal Profits Code restrictions. Not readily available for a Certified Durability Annuity Contract (QLAC). Your life time revenue payments will certainly be reduced with this option than they would certainly be without it. Not offered in all states.

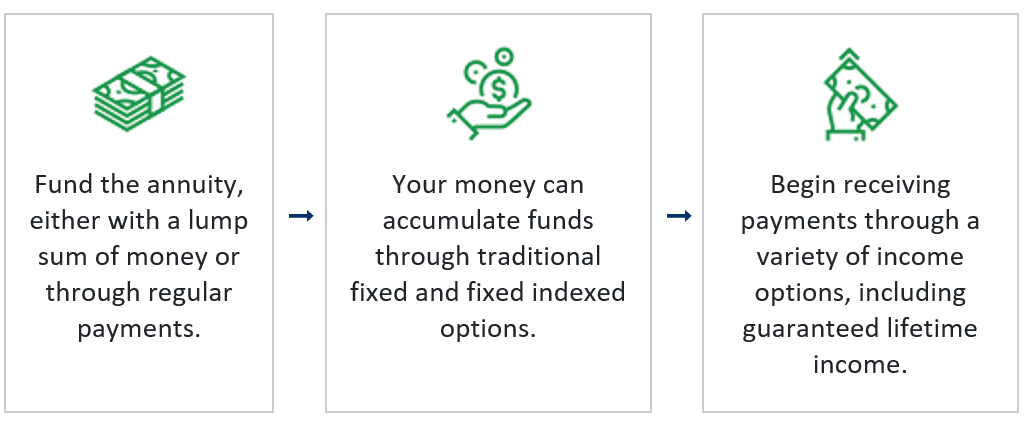

An annuity is an agreement in which an insurance coverage business makes a collection of earnings repayments at regular intervals in return for a premium or premiums you have actually paid. Annuities are typically purchased for future retired life earnings. Just an annuity can pay a revenue that can be guaranteed to last as long as you live.

Fidelity Myga

The most common types of annuities are: solitary or numerous costs, instant or postponed, and dealt with or variable. For a solitary costs agreement, you pay the insurer just one payment, whereas you make a series of settlements for a numerous costs. With a prompt annuity, income repayments begin no behind one year after you pay the premium.

Typically, what these rates will be is entirely as much as the insurer. The present rate is the price the business decides to credit scores to your contract at a particular time. The firm will certainly assure it will certainly not alter rates for a certain time period. The minimum surefire rates of interest is the most affordable rate your annuity will certainly make (annuities at risk).

Some annuity agreements use different rates of interest to each premium you pay or to premiums you pay during different time durations. Various other annuity agreements might have 2 or even more collected worths that fund various advantage options. These collected values might make use of different rate of interest. You get just one of the accumulated values relying on which benefit you choose.

Under existing government law, annuities receive unique tax obligation therapy. Revenue tax obligation on annuities is delayed, which implies you are not tired on the rate of interest your money gains while it remains in the annuity.

Many states' tax obligation legislations on annuities adhere to the government legislation. You should get in touch with a specialist tax obligation consultant to review your individual tax obligation scenario. Many states have legislations that give you a set variety of days to check out the annuity agreement after you purchase it. If you decide during that time that you do not want the annuity, you can return the contract and get all your cash back.

The "cost-free look" duration should be prominently mentioned in your contract. Make sure to review your contract very carefully throughout the "totally free look" duration. You ought to consider what your goals are for the cash you take into any type of annuity. You need to consider just how much danger you want to take with the cash as well.

20 Year Annuity Payout

Terms and conditions of each annuity agreement will differ (variable annuity account). Compare info for comparable contracts from a number of companies. If you have a certain inquiry or can not obtain responses you require from the agent or business, get in touch with the Department.

There are 2 fundamental kinds of annuity agreements: instant and postponed. An immediate annuity is an annuity contract in which settlements start within 12 months of the day of acquisition.

Regular payments are delayed till a maturation date mentioned in the agreement or, if earlier, a date picked by the owner of the agreement. principal guaranteed fixed annuity. The most typical Immediate Annuity Contract payment choices include: Insurance firm makes regular repayments for the annuitant's lifetime. A choice based upon the annuitant's survival is called a life set choice

There are two annuitants (called joint annuitants), normally spouses and routine settlements proceed up until the death of both. The earnings repayment amount might continue at 100% when just one annuitant is to life or be reduced (50%, 66.67%, 75%) throughout the life of the surviving annuitant. Regular payments are produced a specified duration of time (e.g., 5, 10 or two decades).

Explain Annuity

Some instant annuities supply inflation defense with regular boosts based upon a set price (3%) or an index such as the Customer Cost Index (CPI). An annuity with a CPI adjustment will certainly start with lower repayments or need a greater preliminary premium, yet it will certainly supply at least partial security from the threat of rising cost of living.

Income repayments stay constant if the investment performance (after all fees) equates to the assumed investment return (AIR) specified in the contract. Immediate annuities normally do not allow partial withdrawals or provide for money surrender advantages.

Such persons need to seek insurance firms that utilize low quality underwriting and take into consideration the annuitant's wellness status in identifying annuity revenue settlements. Do you have adequate economic sources to meet your income requires without purchasing an annuity?

Lifetime Annuity Calculator Monthly Payout

For some alternatives, your wellness and marital status may be thought about (are life insurance annuities a good investment). A straight life annuity will certainly provide a higher regular monthly revenue payment for an offered costs than life contingent annuity with a duration certain or refund function. To put it simply, the expense of a given revenue repayment (e.g., $100 per month) will certainly be higher for a life contingent annuity with a period certain or refund feature than for a straight life annuity

An individual with a dependent spouse may want to take into consideration a joint and survivor annuity. A person worried about receiving a minimal return on his/her annuity costs might desire to consider a life contingent choice with a duration certain or a reimbursement feature. A variable immediate annuity is usually chosen to equal rising cost of living throughout your retirement years.

A paid-up deferred annuity, likewise generally referred to as a deferred revenue annuity (DIA), is an annuity contract in which each premium repayment acquisitions a fixed dollar revenue advantage that commences on a defined date, such as an individual's retirement date. annuity example. The agreements do not maintain an account value. The premium cost for this product is much less than for an instant annuity and it enables an individual to maintain control over a lot of his or her various other possessions throughout retirement, while securing durability protection

Each exceptional repayment acquired a stream of earnings. At a worker's retirement, the revenue streams were combined. annuity quote. The employer could optimize the worker's retirement advantage if the agreement did not offer for a survivor benefit or cash money abandonment advantage. Today, insurance firms are marketing a comparable item, usually referred to as long life insurance.

A lot of contracts permit withdrawals listed below a specified level (e.g., 10% of the account value) on an annual basis without abandonment charge. Buildup annuities normally provide for a cash money repayment in the occasion of fatality prior to annuitization.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Key Insights on Your Financial Future Breaking Down the Basics of Annuity Fixed Vs Variable Advantages and Disadvantages of Different Retirement Plans Why Annuities

Understanding Financial Strategies A Comprehensive Guide to Annuities Fixed Vs Variable What Is the Best Retirement Option? Advantages and Disadvantages of Fixed Vs Variable Annuity Pros And Cons Why

Annuities Are Guaranteed By

More